Detecting Bank Fraud With Neo4j: The Power of Graph Databases

Neo4j Certified Professional, AWS Certified Developer

3 min read

In an era where financial institutions face billions in losses due to fraud each year, the stakes for effective detection and prevention have never been higher. Traditional methods are often not enough to combat increasingly sophisticated fraud schemes. Enter Neo4j, a graph database that provides innovative solutions for identifying and mitigating fraud in real time through advanced entity link analysis.

GitHub – rajat-kanugo/FraudDetection-Neo4j

The Challenge of Modern Fraud

Fraudsters are increasingly cunning, often collaborating in groups to exploit shared information and create fake identities. These “fraud rings” leverage legitimate contact details to open multiple accounts, build credit, then disappear before the financial institutions catch on. This scenario can result in significant losses for banks and a challenging environment for fraud prevention teams.

A Common Fraud Scenario

- Collaboration: Individuals come together to form a fraud ring, pooling their personal information.

- Identity Creation: Using shared details, they create multiple synthetic identities to open accounts.

- Account Utilization: These accounts are used normally, resulting in increased credit limits.

- The Bust-Out: The fraudsters max out their credit lines and vanish, often after withdrawing funds using counterfeit checks.

Sample Queries for Detection

Using a structured dataset that includes account holders, their contact information, and financial products, we can write powerful Cypher queries to identify fraud rings.

- Identify shared information — This query finds account holders who share multiple pieces of contact information:

MATCH (accountHolder:AccountHolder)-[]->(contactInfo) WITH contactInfo, count(accountHolder) AS RingSize MATCH (contactInfo)<-[]- (accountHolder) WHERE RingSize > 1 RETURN collect(accountHolder.UniqueId) AS FraudRing, labels(contactInfo) AS ContactType, RingSize ORDER BY RingSize DESC

- Determine financial risks — Assess the potential financial impact of identified fraud rings by analyzing the sum of credit limits and loan balances:

MATCH (accountHolder:AccountHolder)-[]->(contactInformation) WITH contactInformation, count(accountHolder) AS RingSize MATCH (contactInformation)<-[]-(accountHolder)- [r:HAS_CREDITCARD|HAS_UNSECUREDLOAN]->(unsecuredAccount) WHERE RingSize > 1 RETURN collect(DISTINCT accountHolder.UniqueId) AS FraudRing, labels(contactInformation) AS ContactType, RingSize, SUM(unsecuredAccount.Balance) AS FinancialRisk ORDER BY FinancialRisk DESC

- Analyze total credit limits across fraud rings — Identify fraud rings by aggregating the total credit limits associated with shared credit card accounts among account holders:

MATCH (accountHolder:AccountHolder)-[]->(contactInformation)

WITH contactInformation, count(accountHolder) AS RingSize

MATCH (contactInformation)<-[]-(accountHolder)-[:HAS_CREDITCARD]->(creditCard)

WITH collect(DISTINCT accountHolder.UniqueId) AS AccountHolders,

contactInformation, RingSize,

SUM(creditCard.Limit) AS TotalCreditLimit

WHERE RingSize > 1

RETURN AccountHolders AS FraudRing,

labels(contactInformation) AS ContactType,

RingSize,

round(TotalCreditLimit) AS TotalCreditLimit

ORDER BY TotalCreditLimit DESC

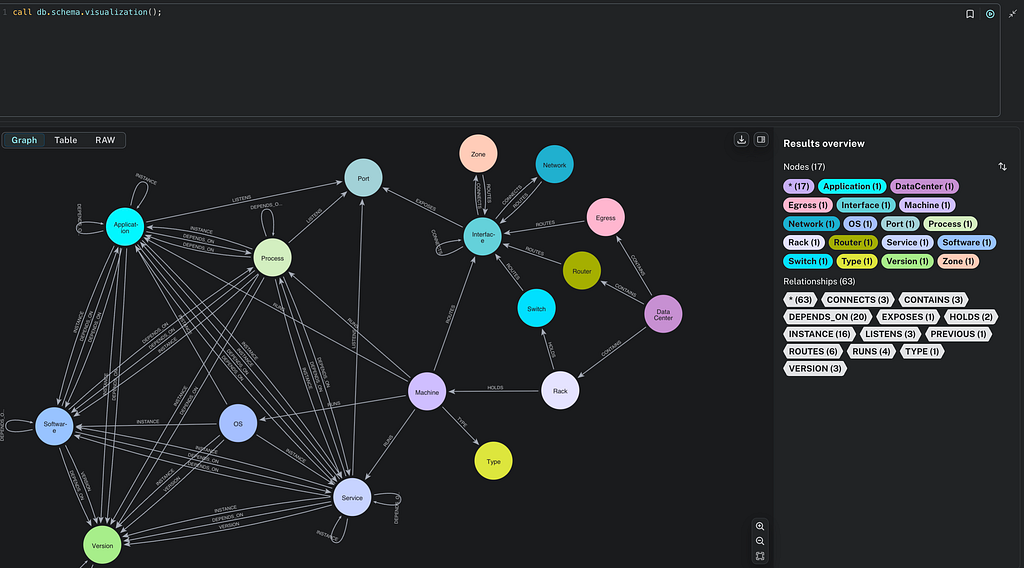

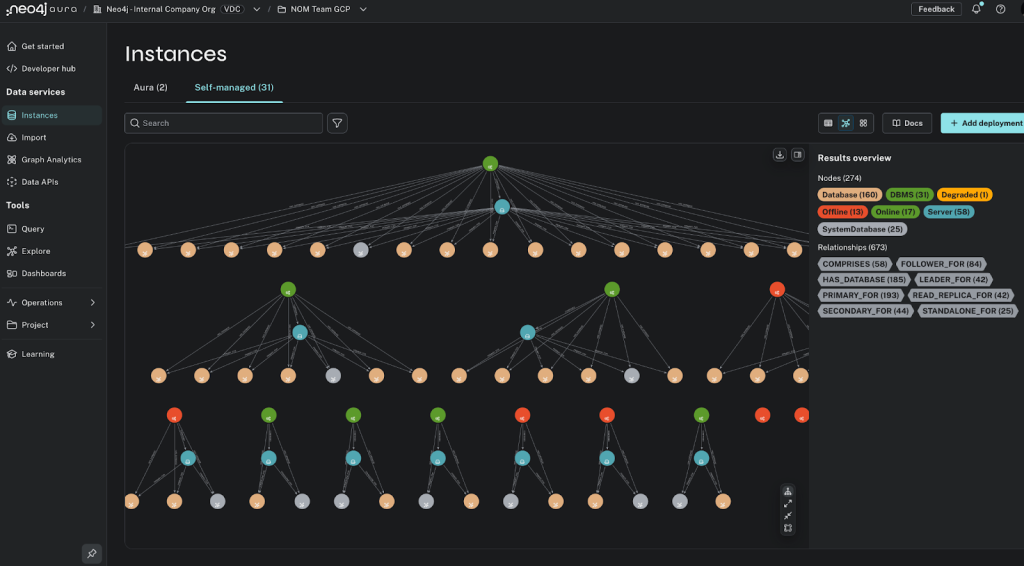

Visualizing Fraud Connections

One of the standout features of Neo4j is its ability to visualize complex relationships. By mapping out connections between fraud rings and their associated accounts, analysts can easily identify clusters of suspicious activity, enhancing the decision-making process and speeding up investigations.

Summary

In the battle against bank fraud, Neo4j offers powerful tools for real-time analysis and detection of fraud rings. By leveraging the relationships inherent in data, financial institutions can significantly enhance their fraud detection capabilities, reduce losses, and improve their overall security posture. By shifting from traditional methods to a graph-based approach, banks can minimize their exposure to fraud, protect their assets, and safeguard customer trust.

Learn More

Check out how Neo4j helps with fraud detection and analytics by reading some use cases, and be sure to read Elevate Fraud Detection With Neo4j on AWS: Uncover Hidden Patterns and Enhance Accuracy.

Detecting Bank Fraud With Neo4j: The Power of Graph Databases was originally published in Neo4j Developer Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.