Arhasi Delivers Trusted, Defensible AI and a 370% ROI with Neo4j and Google Cloud

Arhasi used a Neo4j knowledge graph to ground AI agents, helping a U.S. asset management leader cut compliance monitoring from six months to six weeks.

370%

ROI (asset management client use case)

$1.2 Million

Annual Operational Savings

6 Weeks

Client Time-to-Value, reduced from 6 months

In a regulated environment, an AI-generated insight is only as valuable as its traceability.

Chief Risk Officers (CROs) and Compliance Officers in Financial Services often see the promise of Generative AI hit a huge barrier. While data science teams pilot chatbots that can draft emails or summarize markets, these tools typically remain blocked from production. The reason is structural: Large Language Models (LLMs) function as probability engines, not truth engines. They cannot explain why they generated a specific answer, nor can they guarantee the same answer twice.

Arhasi, an AI Trust and Integrity firm based in Frisco, Texas, calls this the Trust Barrier. Arhasi helps clients overcome this challenge. The founders of Arhasi didn’t just want to build another AI tool; they wanted to build a new standard for enterprise trust. By merging FAANG’s technical rigor with Big4 Consulting’s compliance DNA, they’ve shifted the focus from raw intelligence to Integrity-First AI.

Arhasi’s mission was to create an architecture where GenAI could safely navigate the minefield of financial regulation — handling PII (Personally Identifiable Information), strict audit requirements, and complex portfolio data without a single hallucination.

“A strong data foundation is the only path to strong AI,” says Chiru Bhavansikar, Chief AI Officer at Arhasi. “You can have the best models in the world, but if your data lacks integrity and transparency, you are building on sand.

The Challenge: When Data Wears Disguises

One of Arhasi’s major U.S. asset management clients faced a crisis: its analysts spent thousands of hours manually reconciling data across disparate systems to generate regulatory reports. They were human bridges between disconnected databases, copy-pasting values into spreadsheets to check for risk exposure or policy violations.

A single financial asset like a share of stock lives a fractured life. The bank’s record-keeping system identifies it by a regulatory code. The customer database tracks it by an account ID. The trading system uses a completely different ticker symbol. This fragmentation cost the client millions.

“The grain is different across every system,” explains Bhavansikar. “When a compliance officer needs to report on a customer’s interaction with that product, they have to manually reconcile those views. It’s a massive, manual heavy lift.”

Banks tried to solve this with relational databases (SQL) for years. But SQL relies on rigid tables and joins. Trying to map the complex, many-to-many relationships between Clients, Portfolios, Advisors, Instruments, and Risk Ratings required massive, computationally expensive JOIN operations that slowed queries to a crawl.

The client had tried vector databases to power AI agents. But vectors only store semantic similarity. They can tell you two documents look alike, but they cannot trace the logical path of a transaction or prove why a specific risk alert was triggered.

“If a complex regulatory report is wrong in one specific value, a traditional database offers no absolute way to backtrace how you ended up there,” Bhavansikar notes. “Vector alone can’t do it. You need a technology that understands the relationship, not just the proximity.

From Probabilities to Proof: Selecting Neo4j

Arhasi realized that they needed a truth layer that sat between the enterprise data and the LLM to make GenAI safe for finance. They chose Neo4j.

Unlike relational databases that store data in disconnected rows, Neo4j stores data as a graph of interconnected nodes. It mirrors the real world: A Client owns a Portfolio containing Instruments regulated by Rules.

Arhasi creates a unified, auditable map of the enterprise by ingesting data from Snowflake, Salesforce, and Databricks into a Neo4j knowledge graph.

“Neo4j allows us to drill down level by level — Granularity A, B, and C — without remodeling the data three times,” says Bhavansikar. “We capture the 360-degree view in a single structure. This becomes the ground truth for the AI.”

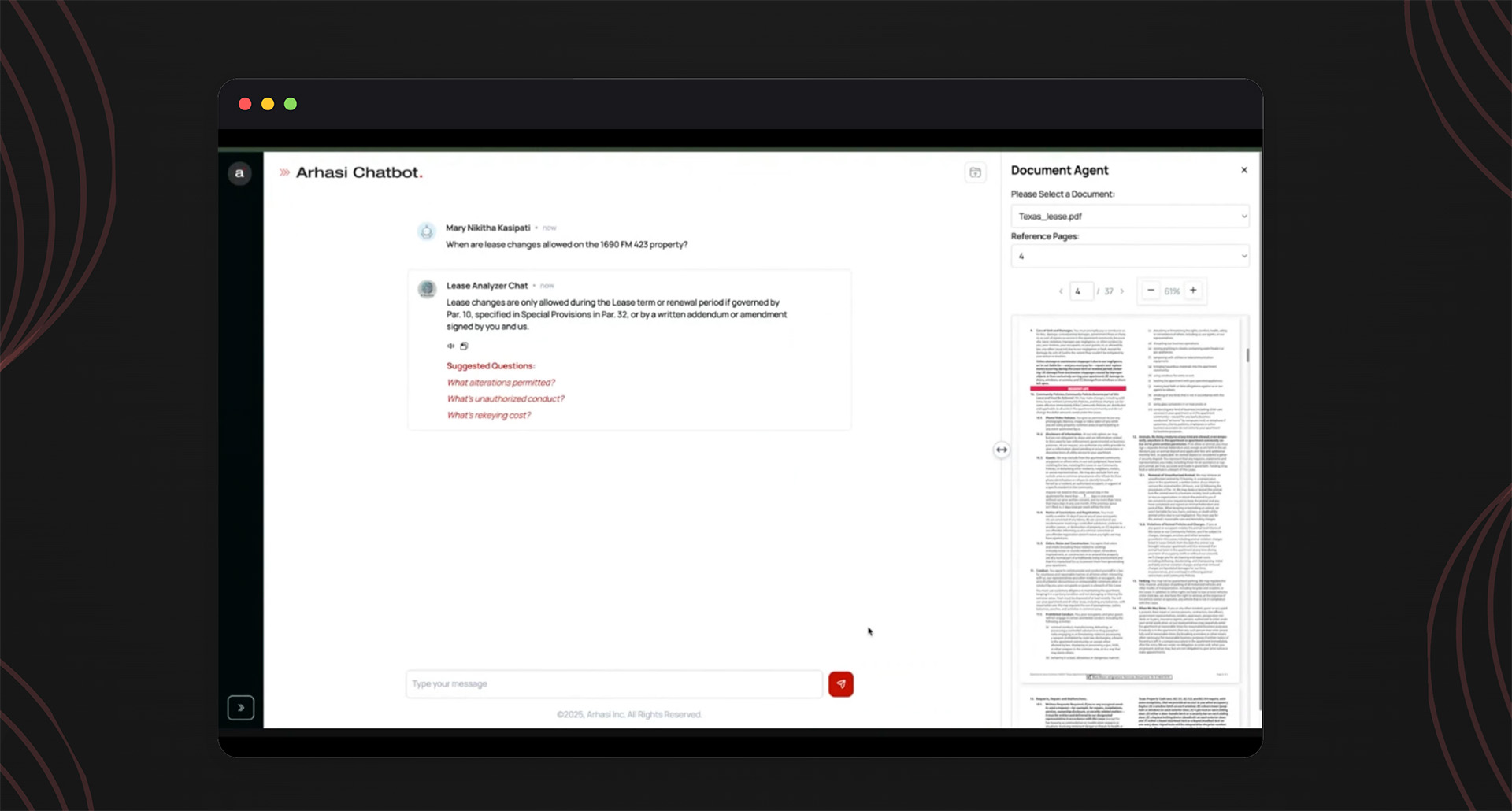

This architecture serves as the foundation for Arhasi’s proprietary TrustHouse. TrustHouse is a software layer serving as the trust fabric between the client’s raw data and the AI models. It orchestrates the interaction between the user, the Neo4j graph, and the cloud models, ensuring that every AI response is grounded in verified enterprise data.

Implementation: The Integrity Stack

Arhasi’s deployment strategy uses the best-of-breed capabilities of the Google Cloud ecosystem to build a deterministic graph-based retrieval (GraphRAG) engine.

The Intelligence Layer (Google Cloud & Vertex AI)

Arhasi relies heavily on Google Cloud for its model infrastructure. “One major advantage with GCP is they own the model,” says Bhavansikar. “This gives us far more control over grounding, fine-tuning, and data privacy, which is non-negotiable for our financial clients.” The team uses Vertex AI and Gemini to handle natural language understanding and generation, ensuring that sensitive PII never leaves the client’s secure VPC.

The Knowledge Layer (Neo4j Graph)

When a user asks a question, for example, “Why is this portfolio flagged for risk?” the system doesn’t guess. Instead, it follows a strict protocol:

- Translation: The agent converts the natural language question into a graph query.

- Retrieval: Neo4j traverses the graph, gathering the exact transaction history and relationship logic causing the flag. For instance, the system can recognize that “AAPL” in the trading system and “Apple Inc.” in the compliance document refer to the same entity, resolving a connection that standard keyword searches would miss.

- Generation: This factual payload is sent to Gemini, which generates a human-readable response based only on the graph data.

3. The Determinism Engine

Financial auditors demand determinism: the guarantee that the same input yields the same output. To achieve this, Arhasi built custom transformers on top of the stack. “Grounding helps accuracy, but it doesn’t guarantee determinism,” Bhavansikar explains. “We studied research from field leaders to manage how the models use GPU resources to ensure behavioral consistency. An audit team can reject your output if it changes every time you run it. We fixed that.”

This combination allows Arhasi to deploy autonomous AI agents that actively monitor data lineage and compliance rules, guarded by the graph structure.

Outcomes: Six Weeks to Value

The impact of this Graph + GenAI approach was immediate for Arhasi’s flagship asset management client.

Speed to Market

The client, paralyzed by the complexity of its manual compliance monitoring, expected a 6-month timeline to pilot a solution.

“Because the graph handles the complexity natively, we didn’t have to spend months building brittle SQL joins,” says Bhavansikar. “We deployed a production-ready solution in six weeks. That speed is our differentiator.”

Financial Impact: $1.2 million annual operating savings

The automated solution delivered a 370% ROI, saving the firm an estimated $1.2 million annually in operational costs by automating the reconciliation of portfolio data and compliance checks.

The Traceability Breakthrough

Crucially, the solution solved the black box problem of Generative AI. If a report contains an error, the system provides the decision trace, showing exactly which document, transaction, or decision logic led to the value. This transparency allowed the client to clear regulatory hurdles that had previously blocked AI adoption.a

“We are enabling debugging for business logic,” Bhavansikar says. “You can retrace the entire path of the data flow. That is what we mean by Integrity.”

Arhasi sees this architecture as the blueprint for the future of enterprise software. It is already expanding the model beyond asset management into “Configurational Security,” using Neo4j to map complex IT infrastructure for Security Operations Centers (SOCs) to identify vulnerabilities that standard scanners miss.

But the core mission remains constant: Making AI safe for the enterprise.

“Clients come to us thinking they have a use case problem,” says Bhavansikar. “They leave realizing they had a data connectivity problem. Once you solve the connectivity in the graph, the AI becomes simple. You move from guessing to knowing.”

Arhasi has filed for formal trademark protection for ‘AI with Integrity,’ and ‘TrustHouse’ the defining principle of their framework. They are proving that truth is the most valuable asset of all in the age of infinite artificial intelligence.