Financial Services & Neo4j: Anti-Money Laundering

Vice President, Product Marketing

4 min read

Reducing the risk of money laundering presents a similar challenge to that of fraud detection when it comes to today’s financial services landscape.

Firms need to know where funds come from and where they are headed, but criminals use indirection to make it difficult to follow money from one point to another. In order to tackle the problem head on, financial services enterprises need a technology powered by data connections.

In this series on Neo4j and financial services, we’ll be looking at how today’s finance enterprises are effectively solving emerging challenges in the industry. In previous weeks, we’ve taken a closer look at financial asset graphs, data lineage, metadata management, and fraud detection.

This week, we’ll take a closer look at anti-money laundering.

Anti-Money Laundering with Graph Technology

Instead of moving money directly, from point A to point B, money laundering criminals move funds to a dozen other points in between with the hope that nobody notices.

Unfortunately, many traditional anti-money laundering (AML) technologies aren’t designed to connect the dots across the many intermediate steps, which means that detecting money-laundering schemes requires a tremendous amount of manual effort. Teams of inspectors can spend months going through reams of data.

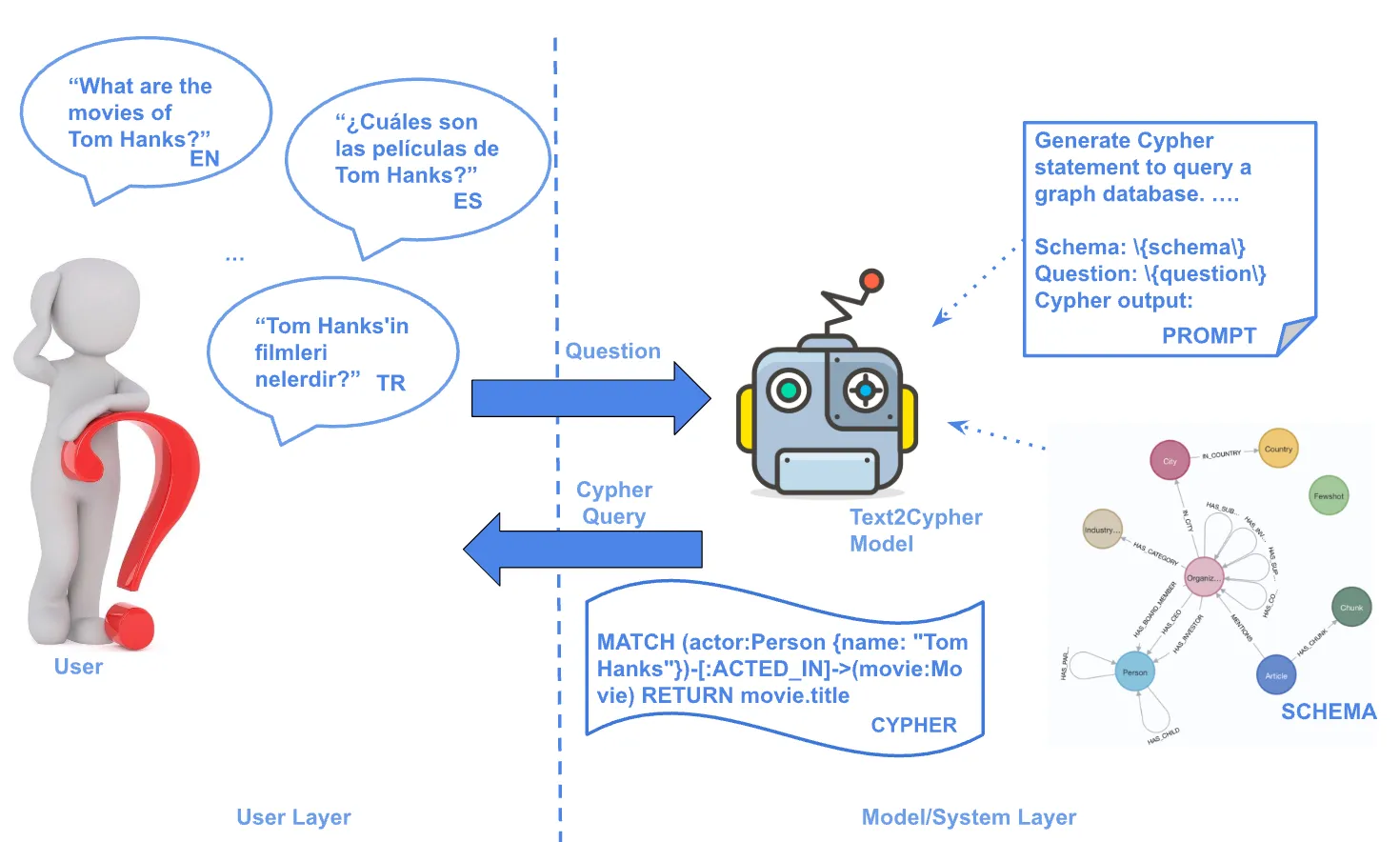

Anti-money laundering teams at financial services firms are using Neo4j to model

companies, accounts and transactions as a graph to discover instances of money laundering.

By graphing the relationships between all of these entities, AML teams can track how

and where funds are moving through automated Cypher queries that map to traditional

money laundering behaviors. Once a suspicious transfer of funds occurs, the system can

automatically flag the transaction for review by an AML analyst.

Case Study: Global Money Transfer Company

One of the world’s largest money transfer companies moves approximately $600 billion each year. The company not only complies with stringent anti-money laundering (AML) requirements in every country where it operates, but it sets the benchmark for investigatory compliance across its industry. The secret: Neo4j.

“Smurfing” — a process by which illicit funds move into the financial system — is a key threat faced by banks and money transfer companies. Smurfing involves splitting illicit funds into smaller amounts in order to bypass the regulatory limits on the amount of money a customer can send or receive, thereby avoiding suspicion by sending smaller sums to a network of beneficiaries.

A typical AML investigation involves checking about 10,000 transactions — a task that was impossible to do efficiently using the static data visualization presented by the company’s SQL-based system.

The global money transfer company surveyed the software market and found that Neo4j enables investigators to visualize the relationships between transfer accounts as well as dig deeper by querying the data dynamically and in real time. This provides greater visibility and enables the company to make connections more rapidly.

Given the success of Neo4j in the company’s European Financial Crimes Department, the graph database was rolled out to investigatory teams in the US, Canada, India, Malaysia and Australia. It is fully integrated with the company’s daily operations and its existing internally developed investigative software.

“At the beginning, compliance was perceived as a constraint,” said the company’s Compliance Manager for Europe. “Now — and this is really the case — we consider it a real competitive edge. It is an advantage to have the best practice inside your company and to be one step ahead of the rest of the market. If we deploy Neo4j and impress all the regulators across the world with this solution, then we define the benchmark.”

Conclusion

Much like financial fraud detection, Neo4j is a critical part of any anti-money laundering infrastructure. Since it stores connected data as first-class entities, it’s the only database to consider for analysis of highly connected datasets.

By connecting the dots across the globe and across your data center, Neo4j helps you hone in on money laundering networks and visualize them in an intuitive way for your AML analysts. In the end, you create a sustainable competitive advantage over money launderers who would use your financial services firm for criminal gain.

In the coming weeks, we’ll take a closer look at other graph technology use cases within the financial services industry, including IT infrastructure monitoring, identity and access management, cybersecurity and customer experience management.

Catch up with the rest of the financial services and Neo4j blog series: