Fighting Financial Fraud with Graph Technology

Solutions Engineer

5 min read

In this blog, I’m happy to share a few insights from material Neo4j presented during GraphTalk Finance, hosted by Neo4j and Deloitte. Throughout the day, multiple presentations showcased how graph technology is being used across the financial services industry to combat fraud and financial crime. Many of these sessions focused on transaction-based fraud and AML detection, and I’d like to highlight how Neo4j is being applied in those projects.

While this post focuses on fraud and AML, it’s worth noting that Neo4j is used across a wide range of financial services use cases, including fraud, customer 360, risk, and security. For more inspiration, you can explore the following overview.

Fraud Detection with Graphs in the Wild

Let’s start by sharing a few customer success stories in fraud from the financial services industry that use Neo4j:

- BNP Paribas Personal Finance is leveraging its existing machine learning models with various embeddings derived from the graph database. As a result, BNP Paribas reduced fraud by 20%.

- iUvity (formerly TODO1) runs real-time fraud detection using Neo4j. Graph technology allows them to capture more patterns, increasing fraud detection by 200% while maintaining the same false positive rate.

- Zurich Insurance uses Neo4j together with Linkurious to streamline fraud triage. Investigators can quickly identify suspicious patterns and connections, uncover previously missed links, and save 5–10 minutes per case, leading to significant cost savings.

Why Fraud Detection Needs Graphs

Now that we’ve covered why graphs matter, let’s look at how they help uncover fraud patterns. Graph technology offers several advantages over traditional systems:

- Flexible data modeling: Fraud typologies and patterns evolve quickly. Graphs use a flexible schema that allows teams to extend their models without costly re-engineering.

- Speed and performance: Relationship-based queries that can take minutes or even hours in relational systems often run in milliseconds in Neo4j.

- Natural representation of financial networks: Accounts, customers, transactions, devices, merchants, and counterparties are all inherently connected. Graphs naturally store these relationships, providing a more intuitive view of the data.

There’s much more to explore, but for now, it’s enough to say that graphs store financial networks in a natural way and enable teams to detect patterns in real time that were previously impossible to find.

The Transaction Graph

To support fraud and AML use cases, Neo4j has developed internal data models that act as a project kickstarter for teams new to graph technology. These reusable models help teams quickly understand how their data can be represented as graphs.

Because this blog focuses on fraud, we’ll concentrate on the transaction graph. This graph defines a standardized Neo4j data model for banking transactions and customer data. At its core, the model connects:

- Customers and the bank accounts they hold

- Customer information such as email, phone number, and address

- Transactions and payments executed by customers

- Counterparties, channels, merchants, and instruments

This structure allows investigators and data scientists to traverse transaction flows, identify suspicious paths, and uncover hidden dependencies.

You can find more information and explore the base transaction model here:

👉 Transaction and Account Data Model.

— Image of the transaction Graph Data Model —

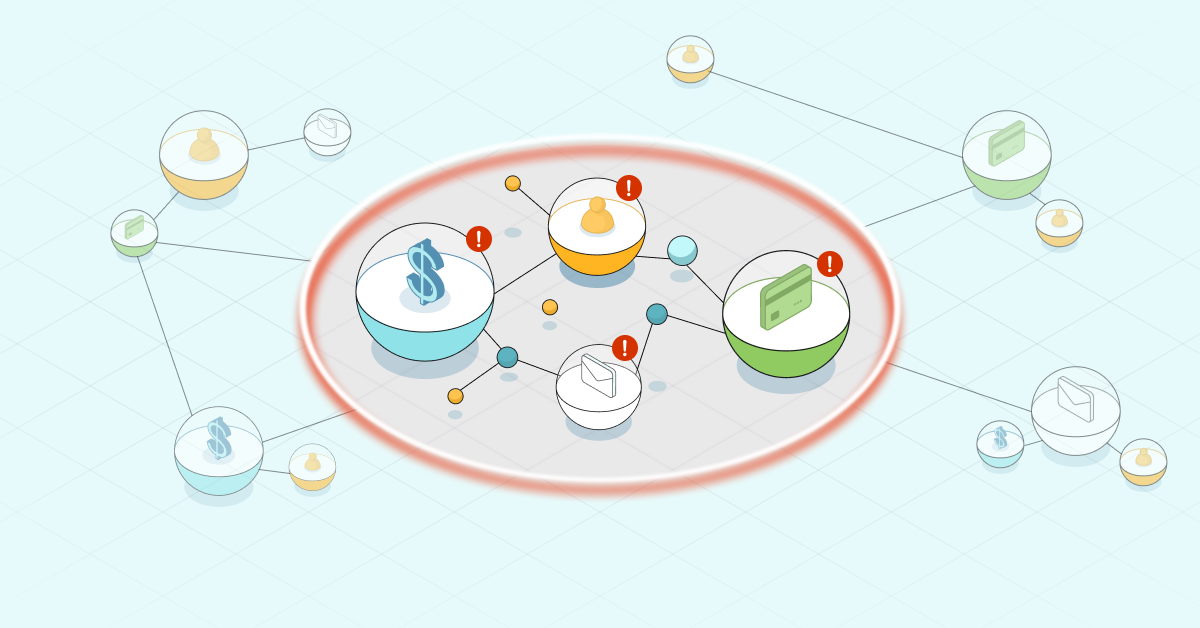

Uncovering Hard-to-Find Fraud Patterns

Now that we have this data model, what kinds of patterns can we identify? Here are a few examples:

- Counterparties of an account: The first pattern is fairly straightforward: finding all parties a customer has transacted with. We start from one account and traverse the graph to find all customers and counterparties linked through transactions. Even though this involves multiple hops (similar to joins in relational databases), graph traversal makes it fast and efficient. Filters can easily be added, such as payment amount, date, currency, or payment type.

MATCH p=(c:Customer{customerId: "cust-00921bfd-62cd-4778-8103-5e7683f1b508"})-[:OWNS]-(:Account)-[:PERFORMS]-(t:Transaction)-[:BENEFITS_TO]-(:Account|Counterparty)

WHERE t.amount > 500

RETURN p

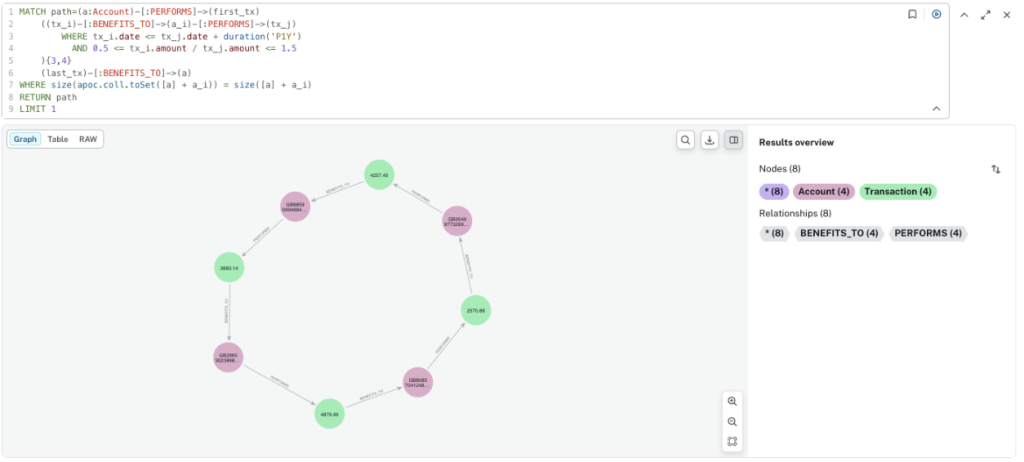

- Fraud Rings: A transaction fraud ring is a group of individuals working together to commit fraud, often moving funds through multiple accounts to obscure the trail. These rings can span locations and use sophisticated strategies to evade detection. Neo4j makes it possible to detect these patterns efficiently:

MATCH path=(a:Account)-[:PERFORMS]->(first_tx)

((tx_i)-[:BENEFITS_TO]->(a_i)-[:PERFORMS]->(tx_j)

WHERE tx_i.date <= tx_j.date + duration('P1Y')

AND 0.5 <= tx_i.amount / tx_j.amount <= 1.5

){3,4}

(last_tx)-[:BENEFITS_TO]->(a)

WHERE size(apoc.coll.toSet([a] + a_i)) = size([a] + a_i)

RETURN path

LIMIT 1

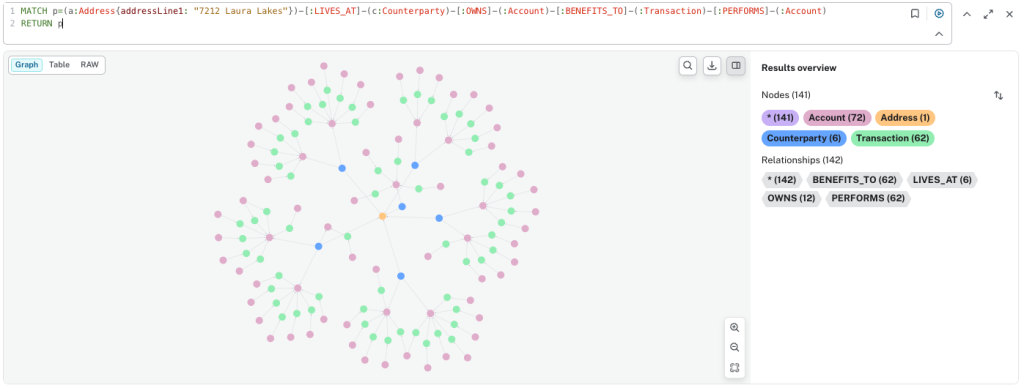

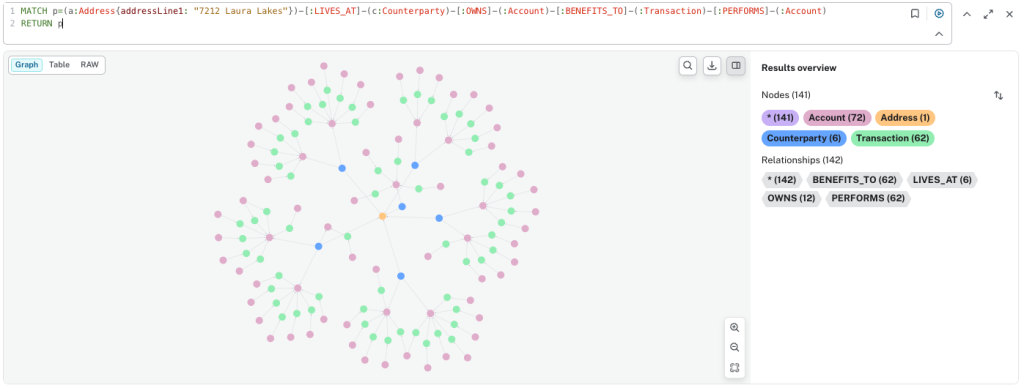

- Payments from an address: In this pattern, we start from a specific address that is potentially identified during an investigation. From that address, we find all parties registered there and then identify all accounts making payments to those parties. Again, filters like payment amount, date, currency, and type can be applied easily.

MATCH p=(a:Address{addressLine1: "7212 Laura Lakes"})-[:LIVES_AT]-(c:Counterparty)-[:OWNS]-(:Account)-[:BENEFITS_TO]-(:Transaction)-[:PERFORMS]-(:Account)

RETURN p

The Future of Fraud Detection with Graphs

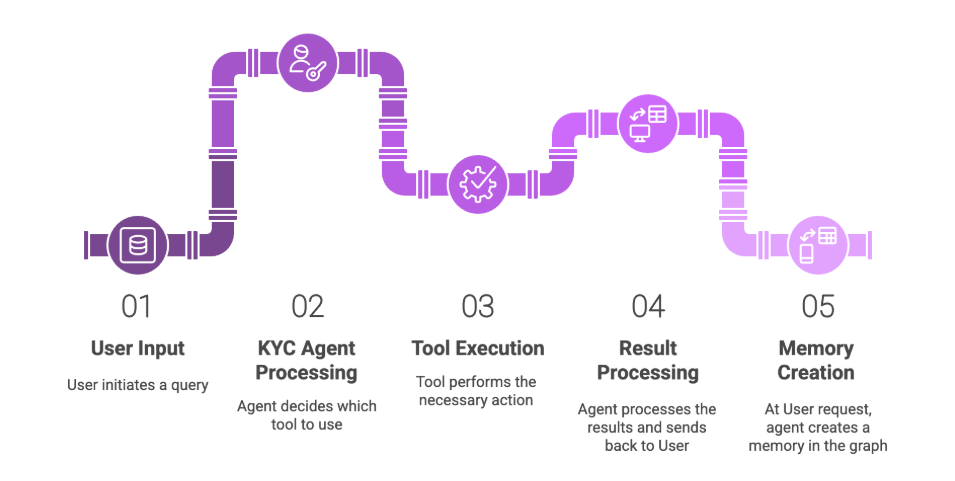

Neo4j is investing heavily in GenAI, and I believe this will open up even more possibilities for fraud detection. For example, Neo4j GraphRAG Agents will allow users to interact with the database using natural language. We’re also seeing growing interest in automating SARs (Suspicious Activity Reports) with agentic AI.

Neo4j continues to prove itself as a strong data layer for agentic AI applications. For more details, check out this post on GraphRAG and Agentic architecture. I hope this post has provided some inspiration for what graph databases can do for fraud use cases. Feel free to reach out with any questions or requests, and stay tuned!

We’ll soon be hosting a webinar on another topic of interest for financial services: UBOs and company ownership, followed by a blog post covering the same subject.